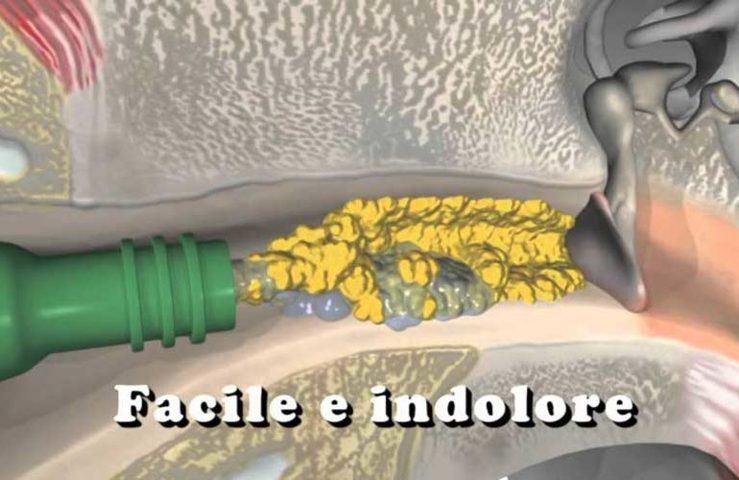

1 pz 10ML universale lavaggio acqua siringa orecchio siringa pulizia dell' orecchio Kit di irrigazione per bambini strumento di rimozione cerume per adulti| | - AliExpress

Medi Grade Kit Siringa Pulisci Orecchie – Siringa per Tappi Orecchie con 3 Punte a Getto Quadruplo –Kit per Pulizia Orecchie di Uso Domestico - Migliora la Chiarezza L'udito : Amazon.it: Prima infanzia

Strumento di lavaggio del cerume dell'orecchio della siringa per la rimozione del detergente del cerume per adulti per bambini per l'irrigazione della pulizia dell'orecchio| | - AliExpress

Siringa per orecchie metallo siringa per orecchie 50 ml 2 inserti pulizia orecchie detergente per orecchie 4250673166428 | eBay

Sanitaria online Siringa auricolav per lavaggio auricolare 1 siringa + 4 dispositivi auricolari | Granfarma

Kit di pulizia per l'irrigazione dell'orecchio Kit di rimozione del cerume con siringa per il lavaggio dell'orecchio Spremere la lampadina Rimozione del cerume per adulti Cura dell'orecchio per bambini acquista in modo

.jpg)

.jpg)